I’m a late-blooming entrepreneur. For years I worked the system to remain a remote employee of a Fortune 500 company no matter where we were stationed in my spouse’s military journey. I thought that was my best option to maintain some type of career, keep my professional resume current, and bring in extra money to support our family.

In 2018, I began my own business. That change validated what I’d been feeling for years.

I wanted more flexibility. I wanted to work on projects that really excited me. I wanted a profession that better fit my family’s lifestyle. But, starting a business means money. It means capital funding or “DIY- ing” the things that someone else had always taken care of for me in the corporate world. Consequently, when I jumped feet first into entrepreneurship, I wasn’t really prepared for money matters.

Nothing is scarier to this entrepreneur than the world of financial management.

Don’t get me wrong - I’m top-notch with personal finances, and I’ve been effectively managing our family finances for years. But when it comes to business finances, my heart starts pumping and my palms get sweaty.

Money is the primary indicator for most business owners to measure whether you are a success story or a sad tale of failure.

Finances make or break your ability to market and build your product or service. Finances allow you the opportunity to grow. But, there are a lot of rules. We joke about keeping receipts in a shoebox. Maybe you’ve even tried to master Quickbooks to keep track of spending and income. Then, the new year rolls around, and the thought of putting it all together for taxes saps my energy. I shudder at the mention of the IRS, and do you fear the word “audit” as much as I do?

I’m afraid I’m doing it wrong, and with finances doing it wrong means significant consequences.

To handle my fear of entrepreneurship finance, I started researching best practices and realized that there is a no-nonsense, classic approach that I can implement. I’d love to share these 5 tips that took the fear out of my finances.

1. Make a budget. Seems simple, right? But, only about half of small business owners make a budget, according to a survey by Clutch. The benefit of a budget is more than just money management. It indicates what you are prioritizing based on where your spending happens. It also sets profit goals and expectations that are realistic for your business. Budgeting forces small business owners to know their numbers, which also means knowing their limits and whether they have the capital to invest when they see an opportunity to grow.

2. Stick to your budget. Entrepreneurs are dreamers and doers, but making ourselves stick to a budget keeps us grounded in reality. Not exactly the most exciting part of being a business owner, but a necessary part of operational success. My best advice is that you find an app that helps with day-to-day tracking, organizing receipts, and creating a big picture snapshot so you know you are on track. Sticking to your budget ensures that you aren’t overspending. When an opportunity arises or an unexpected expense shows up, you will know the best way forward financially.

A budget should be a very fluid document. Don’t expect the budget you made for January 1 each year to be set in stone. In fact, you should be making adjustments based on the reality of your business finances each month. And that’s why tip #3 is so important!

3. Time-block a monthly finance meeting with yourself. Set this in stone. Each month, you need to review what’s happened over the past month with your business finances. Ask yourself these questions:

-Am I on track according to my budget for both profit and expenses?

-Are my budget numbers realistic?

-Where am I overspending?

-Where can I reduce spending?

-What might be coming up over the next month that could affect the budget?

Eventually, these questions become more intuitive and easier to answer. You’ll be able to spot trends in sales and identify issues in your client process that keeps your profit pipeline flowing.

4. Save for a rainy day + retirement.

As an employee, I didn’t have to worry about retirement savings. I had my 401K and a stock investment with the company that I worked for. When I left that position and started my own business, all that went away.

Data from SCORE shows that ⅓ of self-employed persons do not have a retirement plan. Are you part of that 34%? Dear fellow entrepreneur...nobody is saving up for your retirement except you.

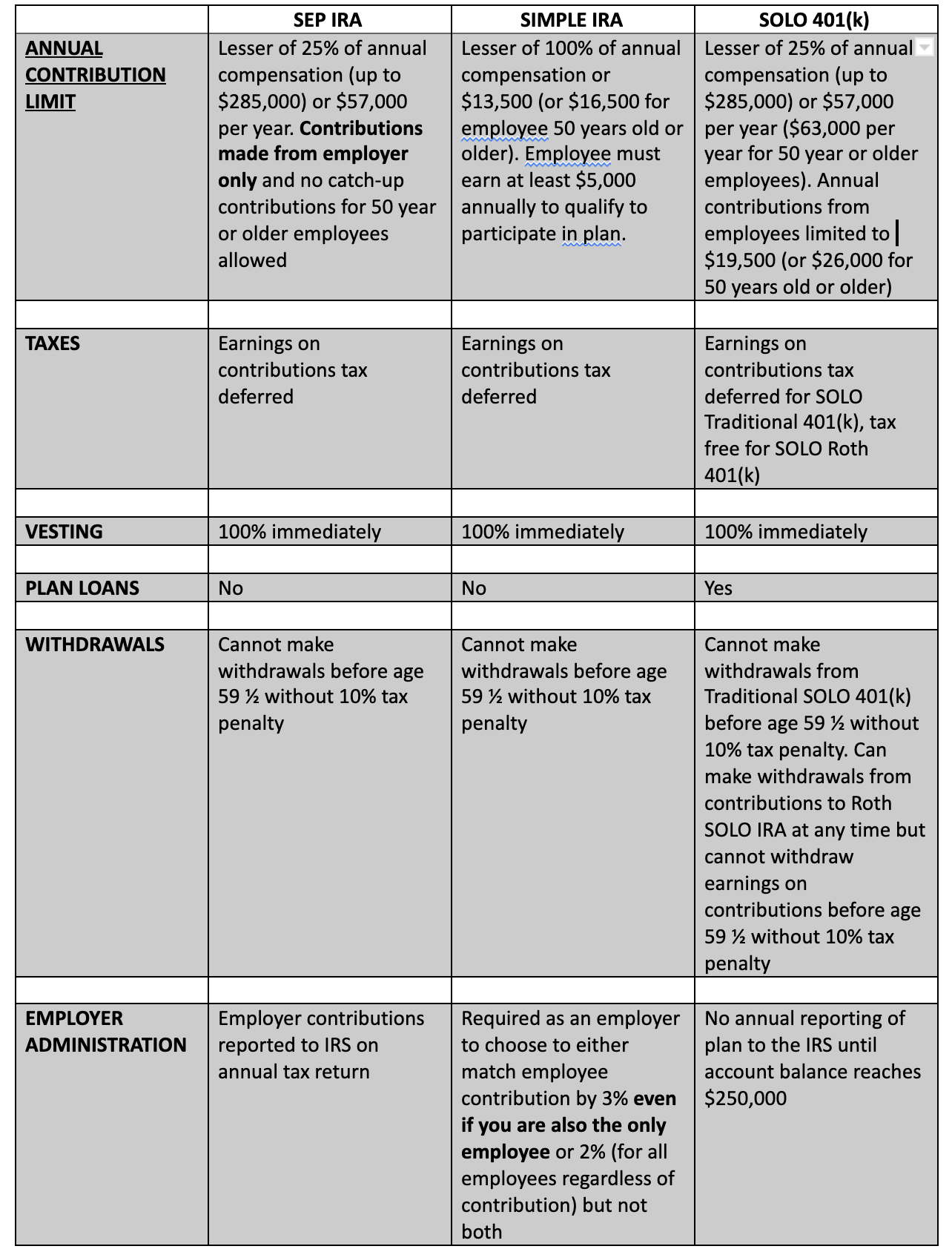

There are many retirement plans you can invest in. Do your research and start putting away as much as you can. Remember this - it’s never too late to start and even starting with a small amount is better than not investing at all! Do what you can and build it as you go.

5. Reinvest in you. This is my favorite part of entrepreneurship finances. When I decide how to invest in my own business, I get to invest in myself because I am my business. Take a workshop or class that makes you a better person or leader or business owner. Join an organization like AMSE that gives you amazing networking and learning opportunities. Buy that program or app that will make your life just a little easier. I consider my reward system for a job well done with my business finances is an investment itself.

Putting these 5 simple tips in place allowed me to feel more confident as a business owner in all financial matters.

Want one last tip? When all else fails or if you are too uncomfortable handling your business finances on your own please look into professional support from a bookkeeper or accountant. There is a list of military spouse entrepreneurs specializing in finance in the MSEG guide that are ready, willing, and expertly able to assist!

Want even more tips and tricks to manage your finances?

Check out the Replays section of the AMSE Member Dashboard for classes from experts and professionals on how to manage your business finances successfully. There is a phenomenal class by AMSE Group Coach Joana Linares that will answer so many questions!