Whether you are just starting up or you are deep in the trenches of a growing business, the day to day operations of any business can be all-consuming. With a significant amount of time and effort needed to manage all the moving parts of a successful business, it is understandable that you might not yet be thinking about your retirement.

If this sounds like you, just know you are not alone.

In a recent report by the Federal Reserve, it was noted that one-fourth of all adults surveyed had no retirement savings whatsoever and of those remaining three-fourths of surveyed adults who had retirement savings, 4 out of 10 adults did not feel confident that their retirement savings were going to be enough for their future needs.

When people discuss specific retirement plans, they usually think of employer-sponsored plans like pensions, 401(k)s, and profit-sharing plans.

However, what if you are both the employer and the only employee? Where can you save for retirement?

There are several retirement plan options for self-employed people, but three of the simplest to set up and manage are SIMPLE IRA, SEP IRA, and SOLO 401(K) accounts.

A SEP (Simplified Employee Pension) IRA allows you as an employer to contribute the lesser of either $57,000 (for 2020) annually or 25% of your annual net earnings from self-employment (net earnings are reached after you deduct from your gross self-employment earnings, the amount for one-half of self-employment tax paid and your SEP contribution amount) with $285,000 as of the annual maximum earnings (for 2020).

Note: employees are not allowed to self-contribute to the SEP IRA, and there are no catch-up contributions allowed for employees aged 50 years and older.

A SIMPLE (Savings Incentive Match for Employees) IRA requires that you wear your employee and employer hat when choosing this plan. The reason for this is that in addition to voluntary employee contributions, as an employer in a SIMPLE IRA, you are required to match your employee contribution by three percent of annual employee compensation for those employees who contribute to the IRA or contribute two percent of your annual employee compensation to all employees regardless of whether they contribute or not. The annual contribution limit is $13,500 or $16,500 if the employee is 50 years old or over (for 2020).

A SOLO 401(k) is designed for small businesses with no employees other than the business owner. The maximum annual contribution limit is the same as the SEP IRA except that the SOLO 401(k) does allow for annual catch-up contributions of $6,000 (for 2020). There is no required annual reporting to the IRS until the SOLO 401(k) balance reaches $250,000. SOLO 401(k) plans have both Traditional and Roth options just like employer 401(k) plans so you can make your contributions from pre-tax or post-tax earnings.

In comparison to the SEP IRA, SIMPLE IRA or SOLO 401(k), a Traditional or Roth IRA allows maximum annual contributions of only $6,500 or $7,500 if you are 50 years old or older. With the higher contribution limits of the self-employed retirement plans, you can save and potentially grow more of your earned income than you would with a Traditional or Roth IRA. You can open a SEP IRA, SIMPLE IRA, or SOLO 401 (k) through a bank or investment brokerage firm.

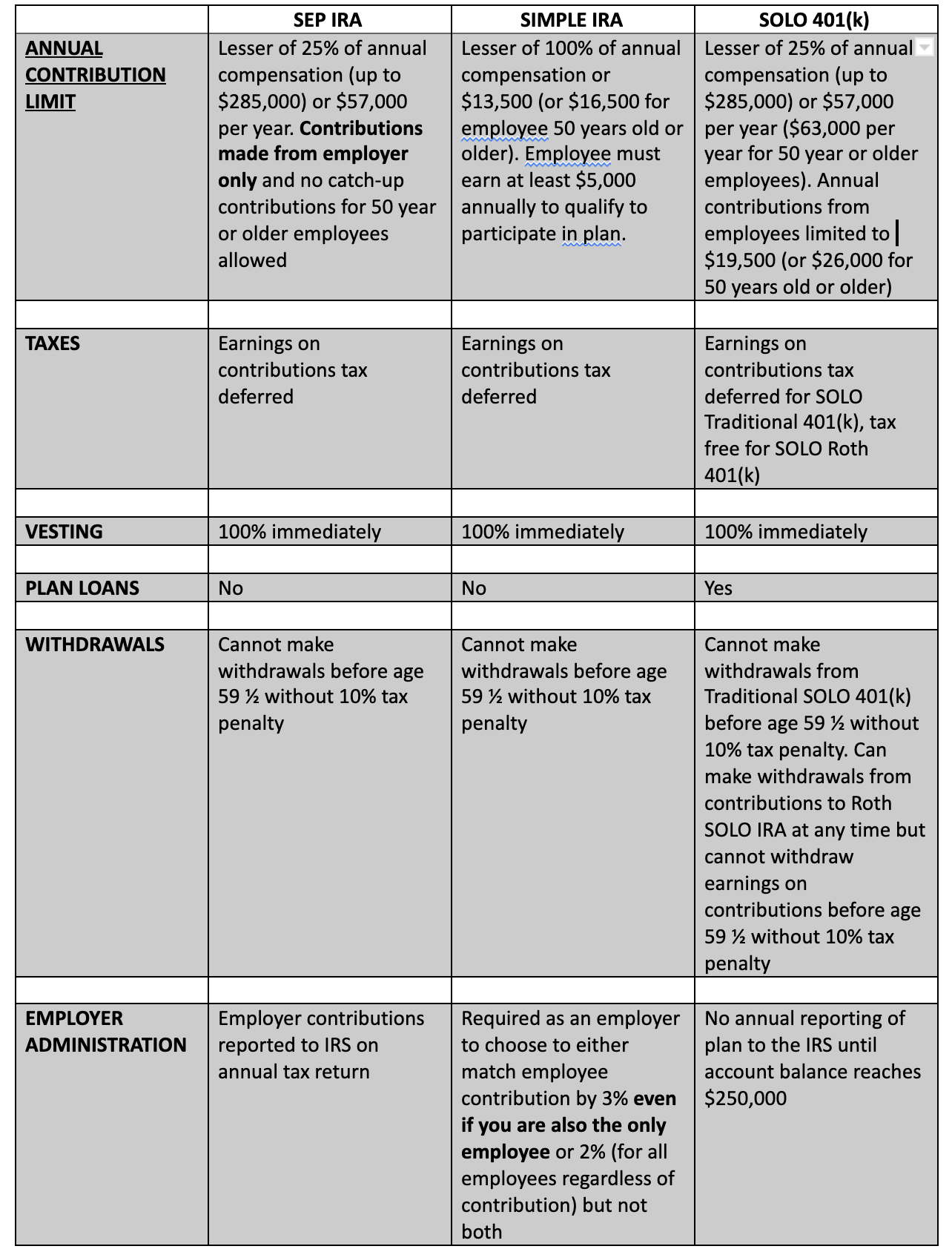

This table helps breakdown each plan:

So now that you know what’s available in the marketplace, how do you decide which plan is right for you?

You will first need to ask yourself some preliminary questions such as:

How much income are you going to need in retirement?

Is it better for you to have the tax benefits of your contributions now or later when you are retired?

What amount of your current self-employment income can you contribute towards your retirement?

Do you feel comfortable setting up a plan yourself and picking your own investments or would you want to have an investment company or broker do it for you?

Once you have made some initial determinations, you can choose to either do more research on your own. These articles from Investopedia and Nerd Wallet may be helpful as well as the retirement planning calculators at Bankrate. The Internal Revenue Service (IRS) also offers general guidance on choosing a retirement plan and an educational video on SEP and SIMPLE plans) or you can reach out to a fiduciary fee-only financial planner to help guide you. If you don’t already have someone in mind, you can find a list of fee-only planners and advisors at XY Planning Network or The National Association of Personal Financial Advisors.

Keep in mind that picking a self-employed retirement plan is only the first step. You will also need to stay in compliance with the rules and reporting for your plan as long as you have it. You can find more information about compliance for self-employed retirement plans through the IRS or through your investment company or advisor.

Dawn Torres-Gale is an Accredited Financial Counselor® and the Single Owner-Member of Our Money Goals, LLC. Our Money Goals mission is to help individuals and couples build their household assets through the identification of specific financial goals and the creation of detailed action plans in support of those goals.

In 2008 Ms. Torres-Gale was chosen by the Financial Industry Regulatory Authority (FINRA) Foundation to be part of a select group of military spouses who received FINRA sponsored training from the Association of Financial Counseling, Planning, and Education to become an Accredited Financial Counselor®. Ms. Torres-Gale received her certification as an Accredited Financial Counselor® in February 2012. Since becoming an AFC®, Ms. Torres-Gale has worked as a Personal Financial Counselor with the Massachusetts National Guard and the Naval Operational Support Center in Portland, Oregon. In 2018 she spent three months providing financial education and counseling services to soldiers stationed at US Army Garrison Wiesbaden in Germany.

Ms. Torres-Gale has a Bachelor of Arts degree in Political Science from San Francisco State University and a Master of Public Administration degree from the University of Hawaii, Manoa. Ms. Torres-Gale has served as a district court mediator in Honolulu, Hawaii from 2003-2005 and as an elected member of the Wachusett Regional School Committee representing the Town of Holden, Massachusetts from 2009-2012. She is the spouse of LCDR Christopher A. Gale, USCG (Ret.) and the mother of three daughters, ages 28, 18, and 15 yrs. old.