Talk of “tough times ahead” are just as predictable as the times themselves from recessions that occur, on average, every three-and-a-quarter years to the cadence of global pandemics.

Of course, the unique intersection of economic shifts coming out of the COVID-19 pandemic and going into the anticipated 2023 recession require a mindful approach, albeit, a simple one.

With these key principles you can bet that your business will be one that holds strong:

Provide a Deeper Solution

While clients are always watching the bottom line and expecting return on investments whether it be with their employees or contractors, during times of greater economic shifts, those eyes on the bottom line become more discerning.

One of the best ways to ensure that your clients continue to see the ROI you deliver as an essential line item on their operating expenses is by deepening your value.

Can you offer to take care of an additional task or piece of their process at a cost to them that’s fair but that doesn’t compromise your overall capacity?

Can you clearly demonstrate how your work is moving the needle and how your ideas moving forward will only continue to foster growth or maintain retention?

The key is ensuring that your client views keeping your services as a no-brainer decision by emphasizing the depth of value you bring to their company. Sure, everyone on payroll is “replaceable,” but we want to demonstrate that replacing our services, either by going with a lower-cost provider or simply doing without, isn’t beneficial in the short or long-term for our clients.

Make Quality Investments Through a Long-Term Lens

Speaking of long-term benefits, similarly to how your clients are assessing their cash flow, you need to bring a trained eye to your own business investments. Whether it’s software subscriptions or membership programs you’re not utilizing regularly, slash those recurring expenses you can’t clearly see a benefit or a return from.

A good litmus test is that if the cost of a tool isn’t less than the cost of the time that tool or service saves you on a monthly basis (based on your average hourly rate), you’re not utilizing it to its fullest capacity – which means you either need a plan of action so that you can start gaining that ROI, or it needs to be cut from your recurring expenses.

These easy budget cuts free up more of your cash flow that you can then use to bolster your business savings, (something you always want to have in place, but especially during times of economic downturn), or invest into other avenues that will support your business more long-term. Those other avenues might include taking a continuing education program that will enhance your skill set and allow you to charge more or bring in higher-paying clientele or investing in a team member who can support you in maximizing your time to allow you to serve more clientele and thus bring in more revenue.

Looking at your investments through this lens of their potential for return six, nine, or 12+ months out is one of the best ways to ensure that you not only remain steady through times of downturn, but that you’re equipped to reap the benefits once the tides shift.

Drill Down on Systems

A practice I’ve found beneficial both with working with clients as a marketing service provider and operating my own business over the last eight years is planning on periods of “building” vs. “growth.”

When outside forces make running a business feel like a tenuous endeavor, or client work ebbs and flows more than you can typically rely on, focusing on building out your systems internally is always a strategic move.

During a “building” season or year, focusing your time and effort on the foundational elements of a sustainable business or evaluating the structure of existing foundational pillars to make them stronger will set you up for success during your “growth” years. For example, creating or refining your standard operating procedures (SOPs), even if you currently operate as a solopreneur, will serve you well when you’re ready to bring on team members or sell your business.

Also, building out sales funnels that support the various revenue streams in your business is another example of building out an asset that you can leverage to save you time and effort in your sales process, as well as increase your capacity when you’re ready to shift into a growth period.

No matter what happens in world economic markets or societal forces at large that affect how everyone works — from Fortune 500s down to families stationed with their service members throughout the world — providing quality work with a patient perspective will never steer you wrong in business.

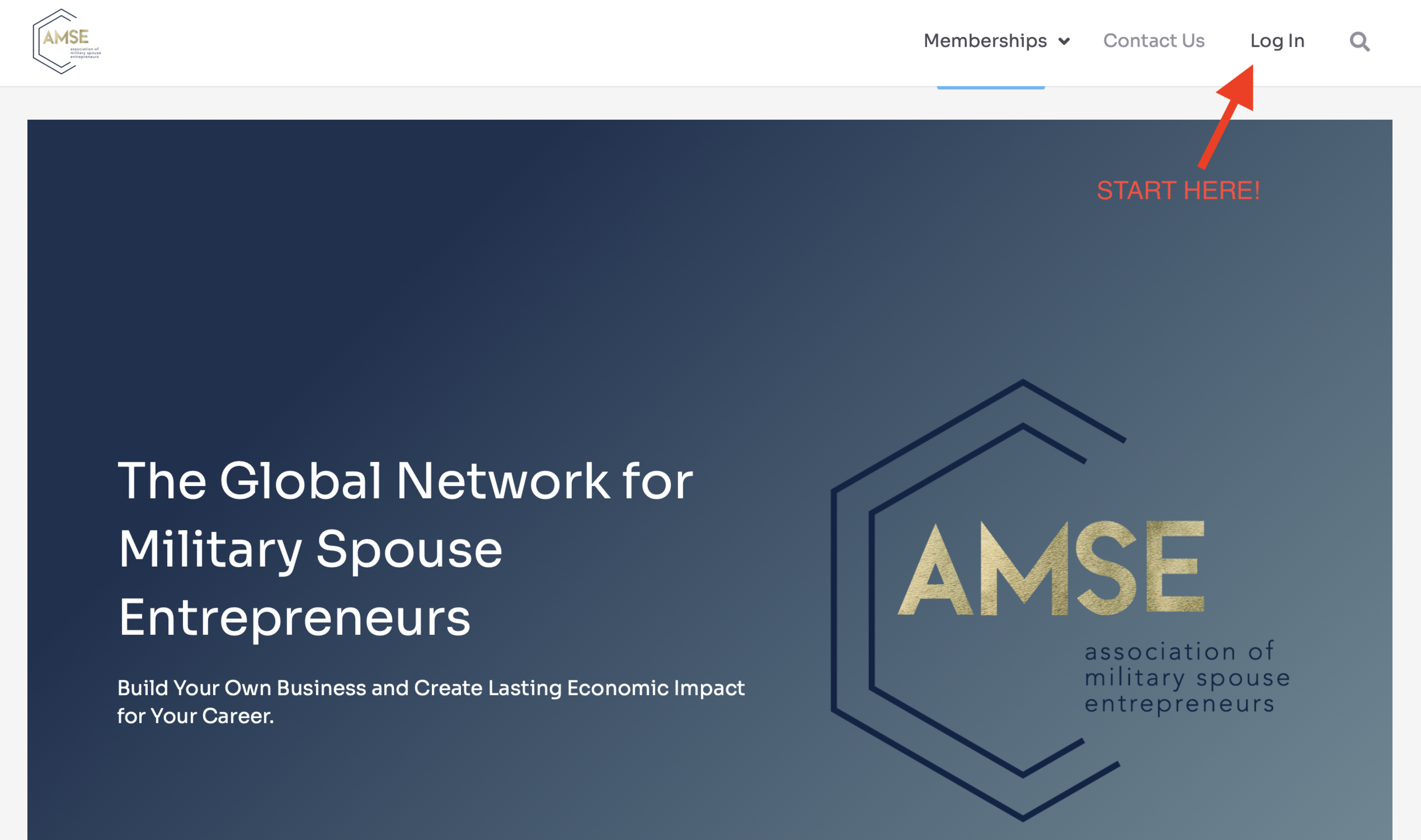

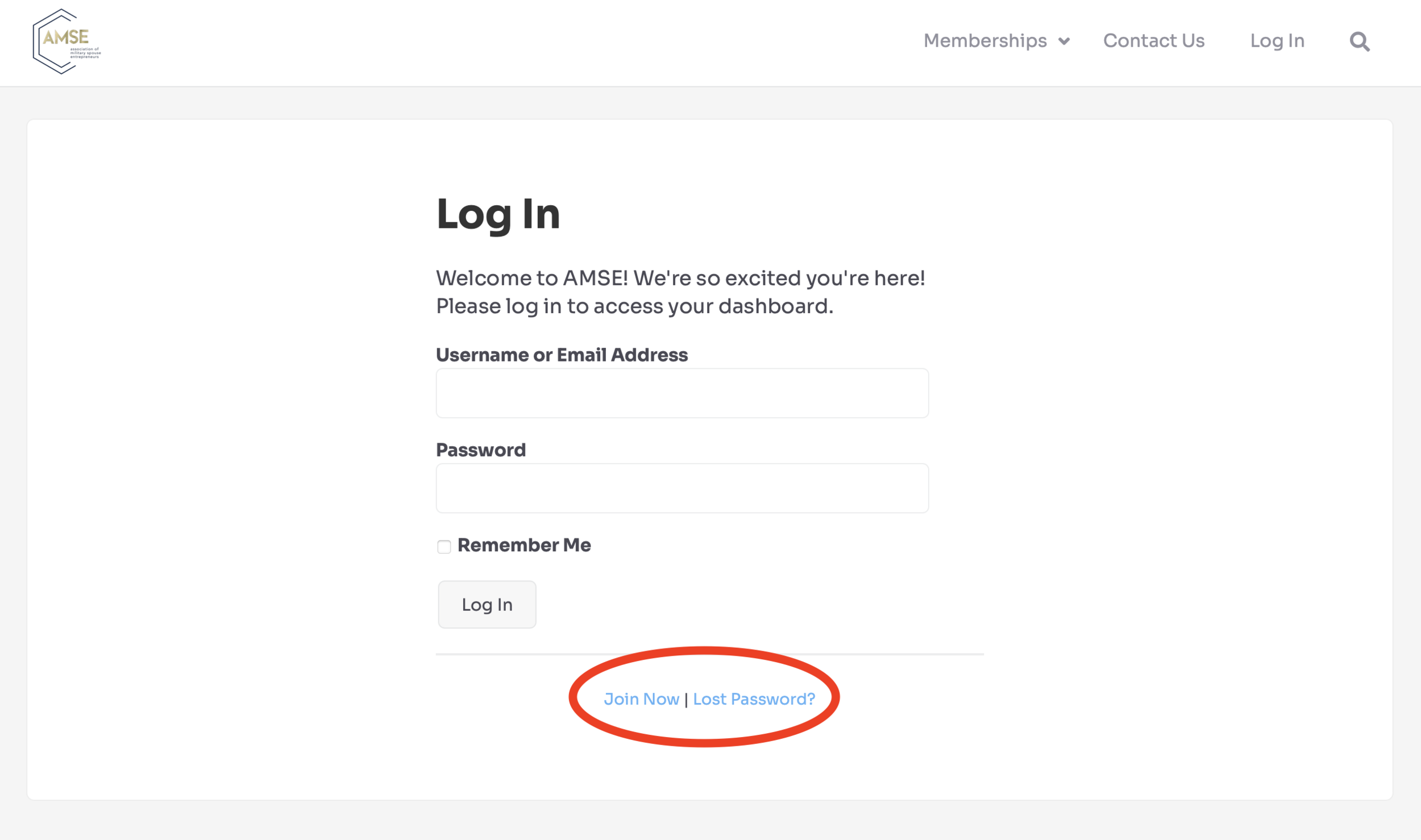

💻 AMSE Action Item: To dive even deeper into how to scale, get AMSE’s premium membership and access Eloise Drane’s “Scaling Your Business” event replay on your member dashboard.

DANIELLE PASTULA

Digital Marketing Strategist and Fractional CMO

Founder of Studio Clary

With 11+ years of experience working as a marketer within the wellness and beauty industries, Danielle has worked with a variety of professionals including award-winning spa and salon owners, beauty and wellness e-commerce brand creators, and leading industry coaches and consultants to establish a magnetic online presence that builds brand authority, increases sales, and cements client loyalty.

Website: https://studioclary.com/FB: https://www.facebook.com/studioclaryLI: https://www.linkedin.com/in/daniellepastula/

IG: https://www.instagram.com/studioclary/